|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

pet life insurance policy choices for long-term careWhat you want to protectYou're not buying a policy; you're buying a future outcome. Years from now, when your pet needs help, you want options that feel calm and fair. A good policy turns a sudden bill into a manageable plan, protecting savings and routines while keeping treatment decisions focused on care, not cost. How coverage usually worksMost plans pay a lump sum or a defined benefit when your pet passes, sometimes including accidental death or specific end-of-life costs. Some policies combine final-expense support with add-ons for memorial services or grief resources. Premiums reflect age, breed, location, and the benefit amount you choose. It sounds straightforward - until definitions, waiting periods, and exclusions step in. That's where clarity matters. Typical components

Costs and levers you control

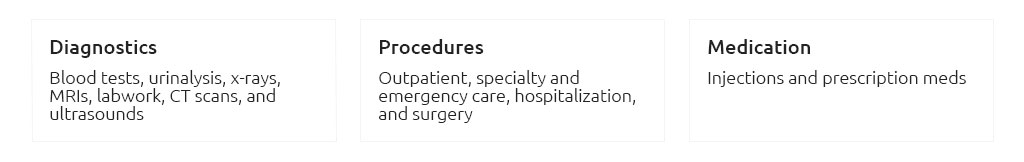

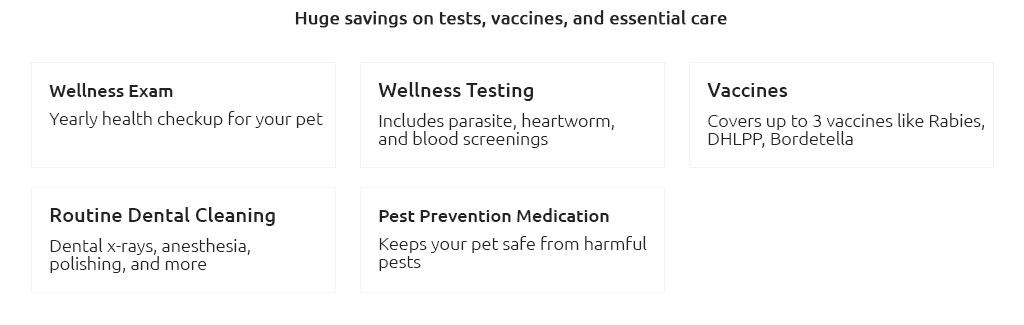

A small real-world momentIt's a quiet Tuesday. A routine dental cleaning turns complicated. After the hardest goodbye, you open the app, submit the veterinarian's documents, and select the memorial option you had quietly prepared. The claim isn't instant, but two days later a confirmation lands. Funds arrive the next week. You're grateful the decision was made earlier, when emotions weren't running the show. What to compare

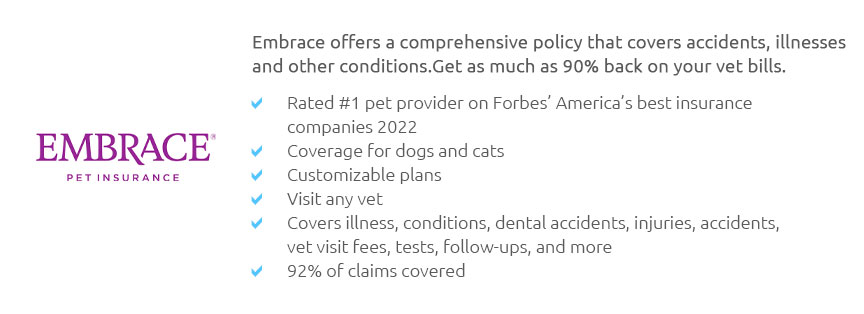

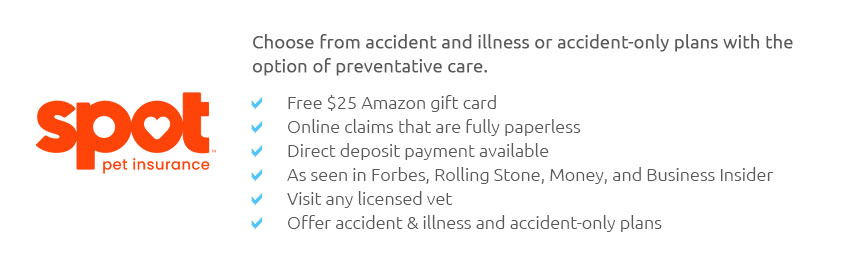

Possible outcomes over the yearsOver a long horizon, premiums can rise as your pet ages. If the policy is well-built, you preserve the benefit you intended without surprise reductions. If it isn't, you might face shrinking benefits or stricter conditions. The long-term impact shows up quietly: less hesitation during tough veterinary conversations, and fewer financial trade-offs with other family goals. Red flags and quiet virtues

How you decide todaySketch your budget, pick a benefit that covers the essentials, and verify the exclusions you can live with. If you feel mild uncertainty, that's normal; real life rarely fits perfectly inside policy language. Choose the option that keeps future choices open, then revisit annually as your pet - and your plans - change. Simple checklist

The right pet life insurance policy won't remove the hard moments, but it can steady your hand when it counts. You'll feel the value most in the outcome: care first, costs second, and a plan that respects the years you shared.

|